Highlights

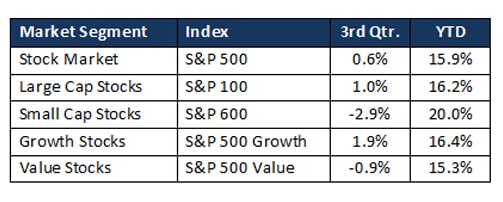

- With a gain of 0.6% in the third quarter, the S&P 500 has now returned 15.9% in 2021.

- Growth stocks outperformed value stocks by 2.8% in the quarter.

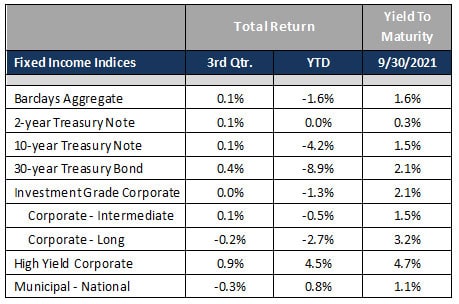

- The Barclays Aggregate fixed income index returned 0.1% as interest rates were largely stable.

- Inflation continued strong, with the Fed’s preferred measure rising 4.2% in the year ending in July.

- The Delta variant’s spread led consensus 2021 GDP growth forecasts to fall from 6.6% to 5.9%.

- As of September 30, the S&P 500 traded at 23 times estimated 2021 earnings.

Equities

Investor fears that the Federal Reserve would tighten monetary policy sooner rather than later dampened equity market returns in the third quarter. Despite significant increases in Covid-19 hospitalizations and the threat of higher taxes to finance ambitious Federal spending, equity prices advanced in July and August in response to strong earnings reports. But after reaching a record high on September 2, stocks fell 4.7% for the month due to investors’ concern that continued strong inflation would force the Fed to raise rates even as economic growth eased, a situation known in the 1970’s as “stagflation”. As a result of the decline in September, the S&P 500 returned only 0.6% for the third quarter, edging its return for the first nine months of the year up to 15.9%.

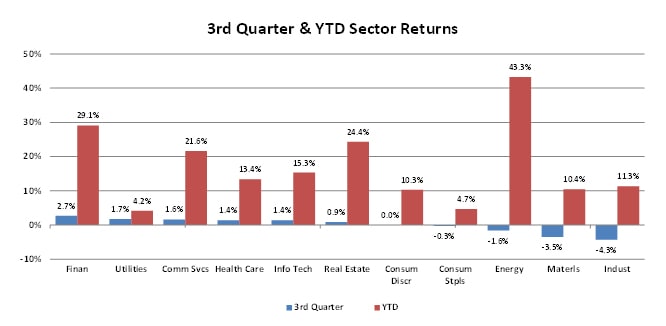

As shown below, large capitalization stocks delivered a positive return in the third quarter while small-cap stocks declined. However, small-cap returns remained well ahead of large cap returns for the first three quarters of the year. Growth stocks outperformed value stocks in the quarter and, as a result, now slightly lead value stock returns for the first nine months of 2021.

Investor fears that the Federal Reserve would tighten monetary policy sooner rather than later dampened equity market returns in the third quarter. Despite significant increases in Covid-19 hospitalizations and the threat of higher taxes to finance ambitious Federal spending, equity prices advanced in July and August in response to strong earnings reports. But after reaching a record high on September 2, stocks fell 4.7% for the month due to investors’ concern that continued strong inflation would force the Fed to raise rates even as economic growth eased, a situation known in the 1970’s as “stagflation”. As a result of the decline in September, the S&P 500 returned only 0.6% for the third quarter, edging its return for the first nine months of the year up to 15.9%.

As shown below, large capitalization stocks delivered a positive return in the third quarter while small-cap stocks declined. However, small-cap returns remained well ahead of large cap returns for the first three quarters of the year. Growth stocks outperformed value stocks in the quarter and, as a result, now slightly lead value stock returns for the first nine months of 2021.

During the third quarter, companies reported strong second quarter revenues and earnings. Corporate earnings have benefitted from unprecedented fiscal stimulus over the last eighteen months. Analysts now estimate that the S&P 500’s 2021 earnings will increase by 62% over pandemic depressed 2020 earnings and 26% over 2019’s earnings. Meanwhile, since the end of 2019, the S&P 500 has returned over 37%, putting its valuation, as measured by the cyclically adjusted P/E ratio, at levels last seen during the tech bubble of 1998-2000.

Fixed Income

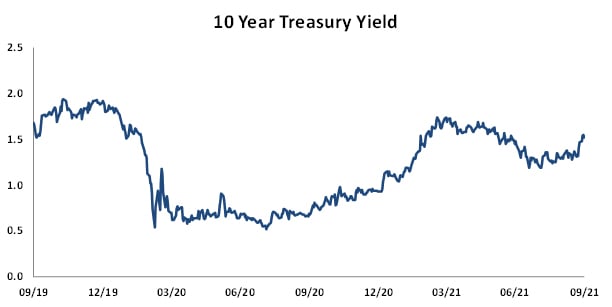

While maintaining the target range for the benchmark Fed Funds rate of 0.0% – 0.25% at its September 21-22 meeting, the Federal Reserve’s Open Market Committee (FOMC) announced that it might start to reduce its monthly bond purchases ($80 billion of Treasuries and $40 billion of mortgage-backed securities) as soon as November and cease them entirely by the middle of 2022. In addition, half of the 18 members of the FOMC expect to raise the Fed Funds rate by the end of 2022. This outlook reveals the FOMC members’ concern about inflation’s absolute level and persistence. The most recent Personal Consumption Expenditures report (the Fed’s favored measure of inflation) shows prices up 4.2% year over year, while the September Consumer Price Index showed an increase of 5.4%. Though the Fed inflation target was changed last year to an “average” rate of 2%, implying that it could be higher for some period of time, it is clear that FOMC members are becoming increasingly uncomfortable with the rise in prices.

Like stocks, bond returns were positive for the first two months of the quarter as yields fell. However, a sharp reversal in longer term yields in late September resulted in essentially flat returns for the quarter and little change in yields. For example, as shown in the table below, the benchmark 10-year Treasury returned 0.1% as its coupon return offset a modest price drop due to a seven basis-point increase in yield. Similarly, interest payments on investment grade bonds offset a small decline in price, resulting in no return. In the case of both 10-year Treasuries and investment grade corporate bonds, however, year-to-date returns remain negative due to the rise in rates. High-yield (“junk”) bond spreads narrowed slightly in the quarter, leading to an almost 1.0% return for the quarter and a 4.5% return year-to-date, reflecting the correlation of high-yield bond and equity returns.

Market Environment

The Federal Reserve continues to argue that the higher inflation we are witnessing is transitory and due primarily to supply chain problems caused by Covid-19. The causes of these problems are many and complex. They include difficulty in getting enough employees to maintain or increase production, scarcity of raw materials, and a shortage of transportation capacity. (The cost to bring a container of goods from Asia to the west coast of the United States is five times higher today than at the beginning of the year.) Another likely factor is increased demand due to concern that needed goods may not be available in the future. Certainly, some of these problems can be expected to abate over time, but no one is sure how much and how soon they will do so.

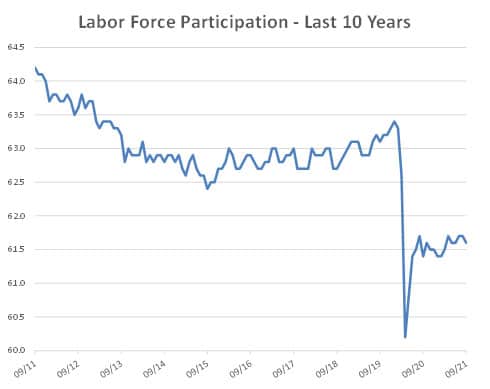

One of the most puzzling aspects of the supply chain problem is the shortage of workers. As of September, there were a record 1.5 job openings for every unemployed person. As a result, manufacturers have had trouble finding employees to increase production, while retail businesses have had to reduce their hours due to a lack of employees. Many people thought that the expiration of enhanced unemployment benefits might improve the labor supply, but so far that hasn’t made a significant difference. Another possible disincentive to work is the elimination of the three-month limit on Supplemental Nutritional Assistance Program benefits (food stamps) so long as the COVID-19 health emergency is still in effect. (It was last renewed on July 19, 2021). Government financial support for households was also increased in March’s $1.9 trillion stimulus bill, which provides annual payments of as much as $3,600 per child to couples earning up to $400,000 and single parents earning up to $200,000 annually. Other explanations for the labor shortage that have been proposed include accelerated retirements, lack of childcare (particularly when schools are not open), fear of contracting COVID-19 at work or while commuting, and a desire to work from home. All these factors could explain why the labor force participation rate has not recovered to its pre-pandemic levels.

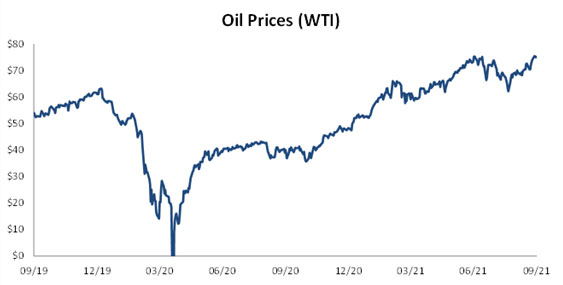

In addition to supply chain problems, another contributor to inflation is the rise in energy prices. Although often excluded by economists (along with food) from the calculation of inflation due to its volatility, energy is a component of many goods and services in the economy and thus can exert a broad influence on the direction of other prices. Although the price of oil plunged very briefly (several minutes) to zero during the depth of the pandemic, it rebounded quickly and since the beginning of the year is up 56%.

The demand for oil is being driven by both a rebound in demand and constrained supply. Following the sharp oil price declines of 2014-2015 and 2020, investors pressured independent oil and gas exploration and production companies to focus on profitability, returns, and free cash flow rather than just production volumes. As a result, these companies have become more cautious about increasing production in response to a rise in price. In addition, major oil companies such as ExxonMobil are under pressure from environmentally oriented investors to reduce investment in exploration and production to avoid having “stranded” assets in a future world that derives more of its energy from renewable resources. At the same time, the public enthusiasm for “green” energy is leading to greater political restrictions on the production of energy from carbon sources.

Unfortunately for today’s consumer, all these factors are leading to a world of higher oil prices since the demand for traditional, carbon-based energy is expected to grow for the next ten to twenty years. This growth will be driven primarily by increased demand from developing countries. That growth in demand, along with the natural decline of current supplies, a slower pace of exploration and production of new sources, and a slow increase in non-carbon-based energy resources, is likely to lead to higher energy prices. Needless to say, this does not bode well for future inflationary pressures.

The market remains keenly focused on the magnitude and duration of the current inflationary pressures. The Fed currently forecasts inflation to decelerate sharply in 2022 and therefore sees no need to rush a return to a “normal” interest rate environment. (The FOMC’s median projection for the Fed Funds rate at the end of 2024 is only 1.8%.) But as September showed, the equity market will not react well if the Fed is forced to adopt a more accelerated pace of monetary tightening to counter inflation.

Focusing on Long-Term Results

With stocks at lofty valuations and bond yields low, these are challenging times for all investors. Navigating this market environment requires consistent focus on long-term goals and an appropriate allocation of assets. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.