Highlights

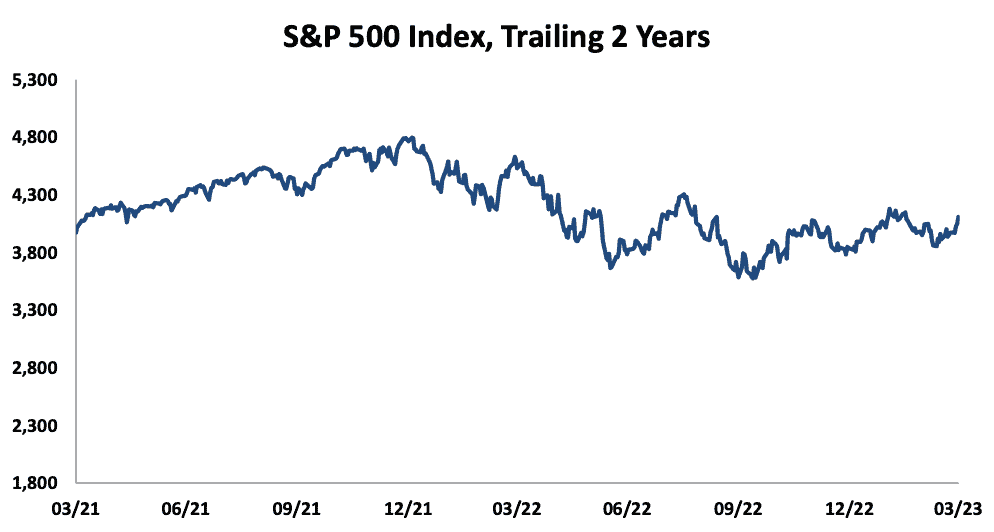

- Buoyed by investor hopes of Fed rate cuts, the S&P 500 returned 7.5% in the first quarter.

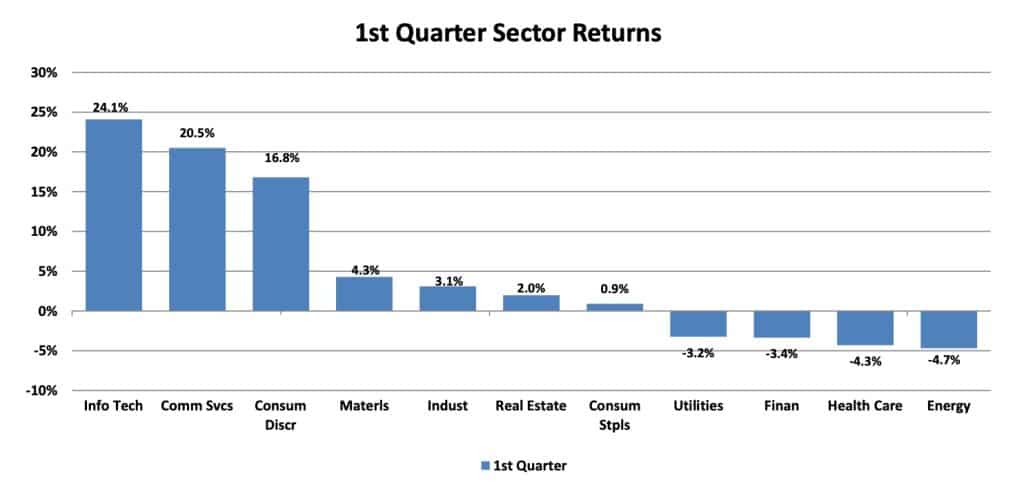

- The Information Technology sector returned 24% and was the largest contributor to the S&P 500.

- Value stocks and small-cap stocks under-performed growth and large-cap stocks.

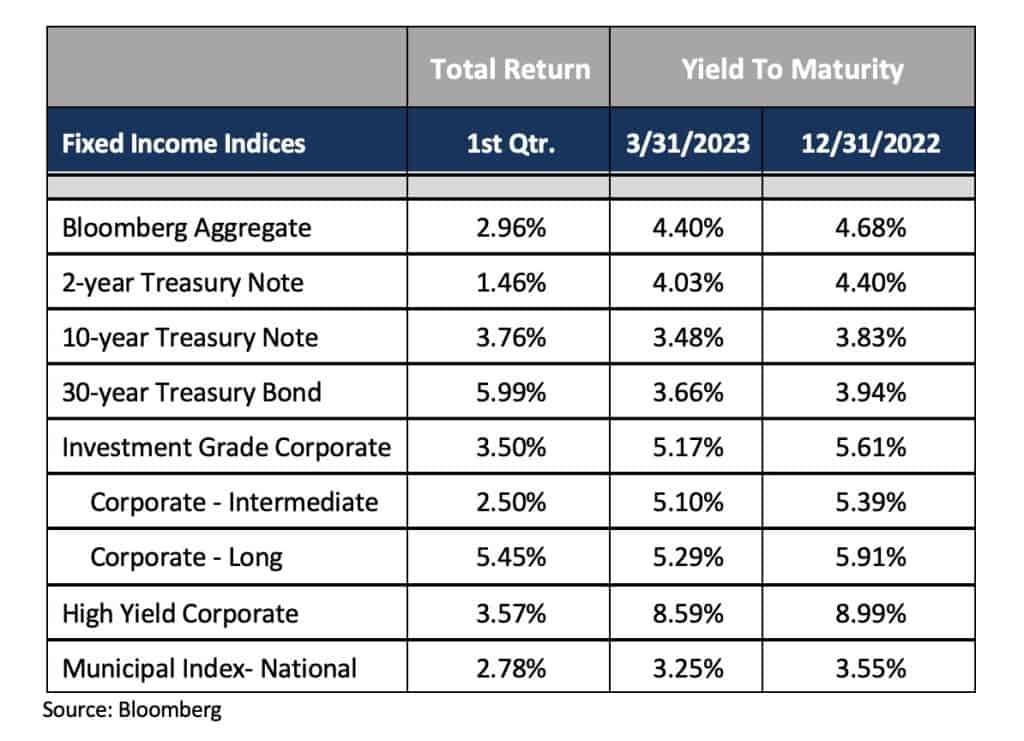

- The broad-market Bloomberg Aggregate bond index returned 3.0% for the quarter.

- Headline inflation continued to moderate, though core inflation remained stubbornly high.

- Despite two large bank failures in early March, the Fed increased the Fed Funds rate by 0.25%.

Equities

January saw a strong rally in the same economically sensitive, speculative, and volatile stocks that led the market up in late 2021 and down in 2022. Investors appeared eager to believe that the danger of a significant recession had faded, inflation was tamed, and the Federal Reserve would begin cutting interest rates later this year. The S&P 500 returned 9.0% through its peak on February 2, before stresses in the banking system caused investors to have second thoughts, leading the S&P 500 to fall 1.4% and end the first quarter with a total return of 7.5%.

While the S&P’s rebound in the first quarter benefitted from a speculative mind-set, most of the first quarter’s return was due to a familiar set of very large-capitalization “tech” stocks. Large cap stocks, led by tech stocks, outperformed small caps by 7.6% while value stocks, weighed down by banks, trailed growth stocks by 4.4%. However, for the last 12 months, growth stocks have still delivered double-digit losses while value stocks are essentially unchanged. Large and small cap stocks are down by close to the same amount in the last year.

Three sectors – Communications Services (Alphabet, Meta), Information Technology (Nvidia, Apple, Microsoft), and Consumer Discretionary (Amazon, Tesla) – provided double digit gains and most of the index’s return. Without the contribution of the Information Technology sector, for example, the S&P 500’s return would have been only 2.7%. Four sectors – Utilities, Financials, Health Care, Energy – delivered negative returns, with the Financial sector’s results hurt by the decline in regional bank share prices following the failures of Silicon Valley Bank (SVB) and Signature Bank.

Despite the stock market’s rebound, some investors remain skeptical and view the rally as temporary relief in a continuing market downturn. This view is bolstered by the fact that the rally in the risky stocks doesn’t necessarily match their fundamentals. An example of the risk taking in the first quarter, and very reminiscent of the speculation in early 2021, is the stock of online-only used car retailer Carvana. Carvana posted sharply lower car sales and laid off more staff in January after cutting around 20% of its workforce last year. Further, its junk-rated bonds trade around 50-60 cents on the dollar. Despite the obvious operational stress at Carvana, the shares were up 106% in the 1st quarter after being up a dizzying 208% at their 2023 high on February 2nd.

Wall Street analysts expect S&P 500 corporate earnings to fall 5% in the first quarter of 2023, which would come on top of a 3.2% year-over-year decline in the fourth quarter. While analysts have been lowering their forecasts for the first quarter, they continue to expect stronger growth in the second half of the year, which contrasts with many economists who expect the economy to be in a recession by then. Meanwhile, the S&P 500 trades at a robust multiple of over 18 times expected 2023 earnings.

Fixed Income

The most recent reports on inflation showed that it continued to ease, but still remained well above the Fed’s targeted 2.0% annual rate. The Personal Consumption Expenditures (PCE) price index, the Fed’s favored measure of inflation, increased 0.3% in February, down from January’s increase of 0.5%, but ahead of the average monthly increase for the last quarter of 2022. The Consumer Price Index report for March showed month-over-month prices up 0.1%, with a fall in Energy prices of 3.5% making a substantial contribution to the overall rate. However, total first quarter month-over-month CPI was up 1.0% compared with 0.8% in the fourth quarter. (All figures are seasonally adjusted.)

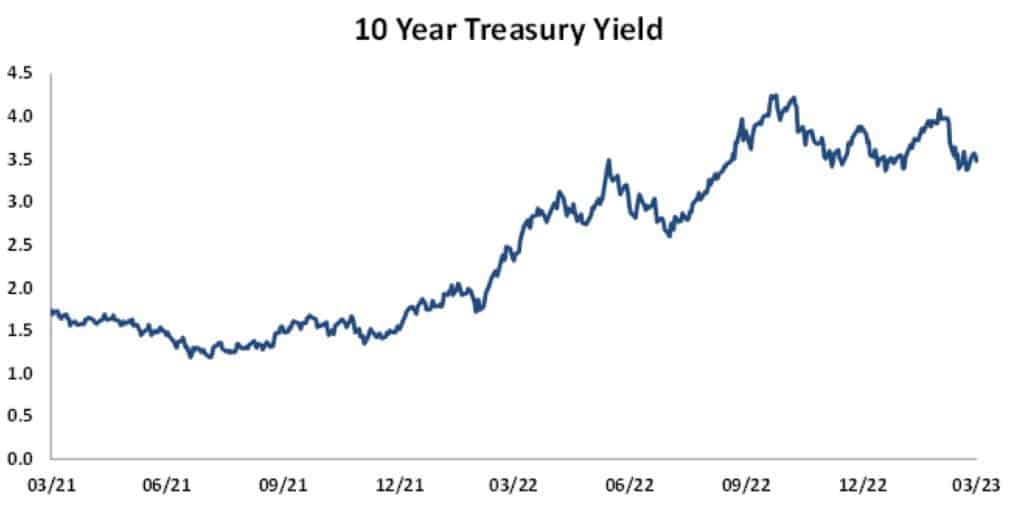

Having increased the targeted Fed Funds rate by 50 basis points in December, the Federal Open Market Committee (FOMC) slowed the pace of increases to 25 basis points in February. Despite the banking crisis, the FOMC decided at its March meeting to raise rates by another 25 basis points to a range of 4.75% – 5.0%. The median forecast of FOMC members for the year-end Fed Funds rate was 5.1%, with rates expected to decline in 2024. In addition to increasing rates, the Fed has also been shrinking its balance sheet from its peak of $8.9 trillion in March of 2022 to $8.3 trillion last month. The current plan is to let maturing securities reduce the outstanding balance by up to $95 billion a month, until the portfolio is reduced to a size that the FOMC judges “appropriate”, though probably far north of the $4.2 trillion pre-pandemic level.

Bond market returns trailed equity returns in the first quarter, with the Bloomberg Aggregate Index returning 3.0%. In the wake of the failure of SVB and Signature Bank, Treasury yields, except for the very shortest maturities, fell between 32 and 43 basis points during the quarter as investors sought safety and reasoned that tougher credit conditions would lead to a slower economy and Fed rate-cutting later this year. The 2-year yield fell to 4.0% and the benchmark 10-year to 3.5%. Investment grade corporate bonds returned 3.5% for the quarter compared to 3.8% for the ten-year Treasury, implying a slight increase in the risk premium required by investors. The yield curve remained inverted, with the two-year Treasury yield 0.55% higher than the ten-year yield.

Market Environment

The first quarter witnessed the first significant aftershocks in the U.S. from the Federal Reserve’s rapid shift to a tighter monetary policy. While a sign of strain in the global financial system appeared in British pension funds last fall, here it manifested itself in the banking system. Following a rapid outflow of deposits at SVB and Signature Bank on March 10, the FDIC decided to close the two banks, which made them the second and third largest banks ever to fail. In addition, after consulting with the Federal Reserve and the Secretary of the Treasury over the weekend of March 11-12, the FDIC decided that the runs on these banks threatened general confidence in regional banks and so made them “systemically important”. This designation allowed the FDIC to guarantee all deposits above the normal $250,000 limit and the Fed to set up a bank lending facility that would accept government securities as collateral at face value rather than their actual, lower, market value. Ironically, it was the large losses that Silicon Valley took on its (long-term) Treasury security portfolio that sparked the run on its deposits. Had this new Fed lending facility been announced on March 9, it would have probably stopped the run on SVB and subdued the contagion that led to Signature Bank’s failure.

Both banks, along with many others, had seen a significant increase in uninsured deposits in 2021-22 as Congress, along with both the current and former Presidents, flooded the country with money. SVB invested much of this inflow in long-term Treasury securities, which, while having no credit risk, did expose the bank to the risk of rising rates. The Fed’s own balance sheet has not been immune to the issues that sank SVB and is currently stressing many other banks. With interest rates up, the Fed is now having to pay more on the bank deposits it holds, while it is stuck with low yields on its portfolio of long-term bonds and mortgage-backed securities. As a result, it is now losing money and is no longer able to pay profits to the U.S. Treasury. Although it’s not good for the Fed, the U.S. government, or ultimately the taxpayer, there is a kind of poetic justice in this situation since it is precisely the Fed’s misguided policy to suppress long-term rates for so long that led it (and banks) to acquire those low yielding securities. At the same time, this policy fostered speculative mal-investment and provided the inflationary fuel that the fiscal stimulus of 2020-2022 ignited.

In the wake of these two bank failures, there is much talk about tighter regulation of regional banks. However, it is well worth noting that the “stress tests” that the largest banks are required to undergo did not, as of February of this year, consider a scenario of rapidly rising rates. So even if this greater level of scrutiny had been applied to these banks, it wouldn’t have identified the major problem. Interestingly, an article by Jason Zweig (The Wall Street Journal, March 17) points out that from 1864-1913 (before banks were regulated by the Fed) depositor losses totaled approximately $1 billion in current dollars, or 1% of GDP. The losses from just the savings and loan crisis of the 1980’s and the banking crisis of 2007-2008 were more than 10% of GDP. As Zweig puts it, “This all goes to illustrate an even bigger problem: Central authorities aren’t omniscient and omnipotent, and their efforts to wring risk out of the system may make it more dangerous, not less.”

An even bigger systemic issue is that banks today only account for 50% of global financial assets, down from 60% in 2008. The rest is held by a variety of so-called Non-Bank Financial Intermediaries (NBFI) such as insurance companies, pension funds, mutual funds, hedge funds, and private equity funds, many of which are loosely regulated or not regulated at all. Of course, it is the growth of bank regulation and the monetary policy of low rates for over a decade that has encouraged the growth of these NBFIs.

Despite the FOMC’s own forecast of steady to higher rates, investors continue to expect that the Fed Funds rate will peak in May and decline in the second half of the year. In a market conditioned for a decade to expect any fall in stock prices to lead to rate cuts, this expectation of rate cuts has sustained stock prices at surprising levels given the change in rates and the risk of a recession later this year. Recessions historically resulted most often from a contraction in credit, which is what the Fed is doing by raising rates. In addition, there were already signs that banks were tightening credit before the recent crisis. That tightening can only be expected to continue given the recent bank collapses, especially among the regional and community banks. With most analysts still expecting another Fed rate hike in May, we will all just have to wait and see where the next weak link in the system manifests itself. In the meantime, we are likely to see continued volatility in both bond yields and stock prices.

Focusing on Long-Term Results

These remain challenging times for all investors. Navigating the risks in this market environment requires consistent focus on long-term goals and an appropriate allocation of assets. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.