Highlights

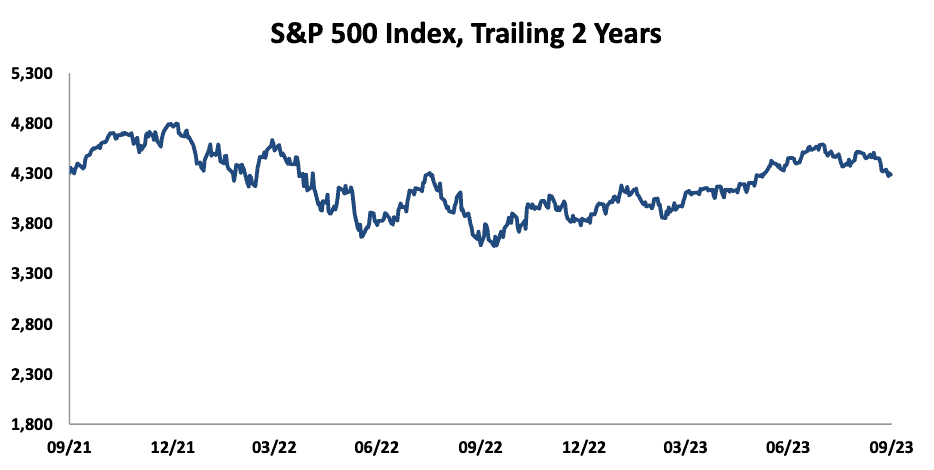

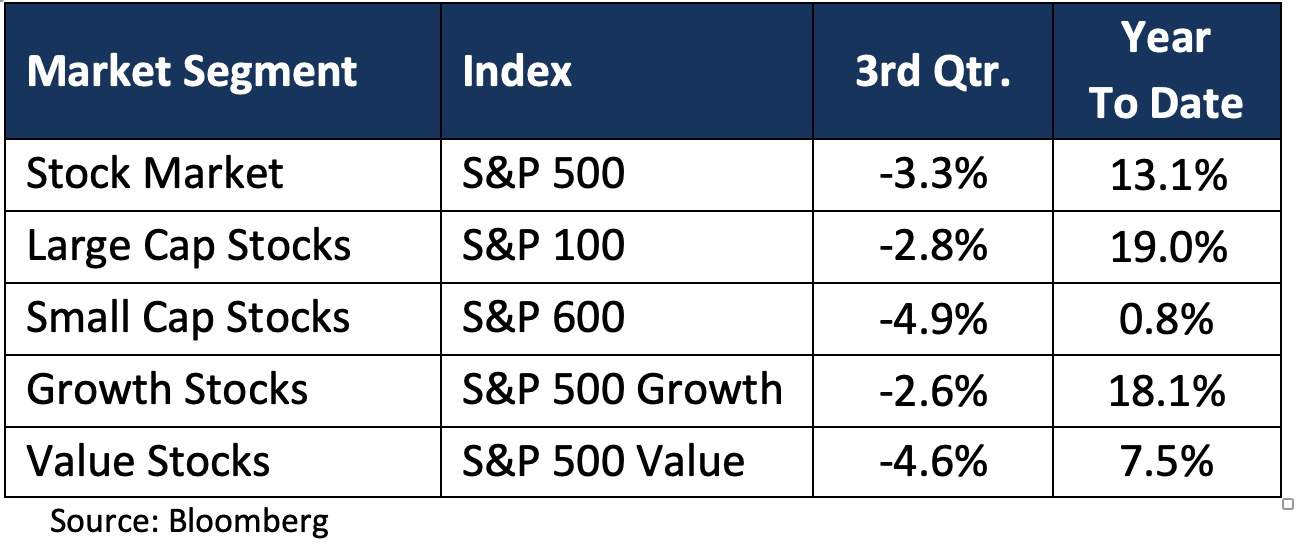

- Following continued gains in July, the S&P 500 fell sharply and lost 3.3% for the quarter.

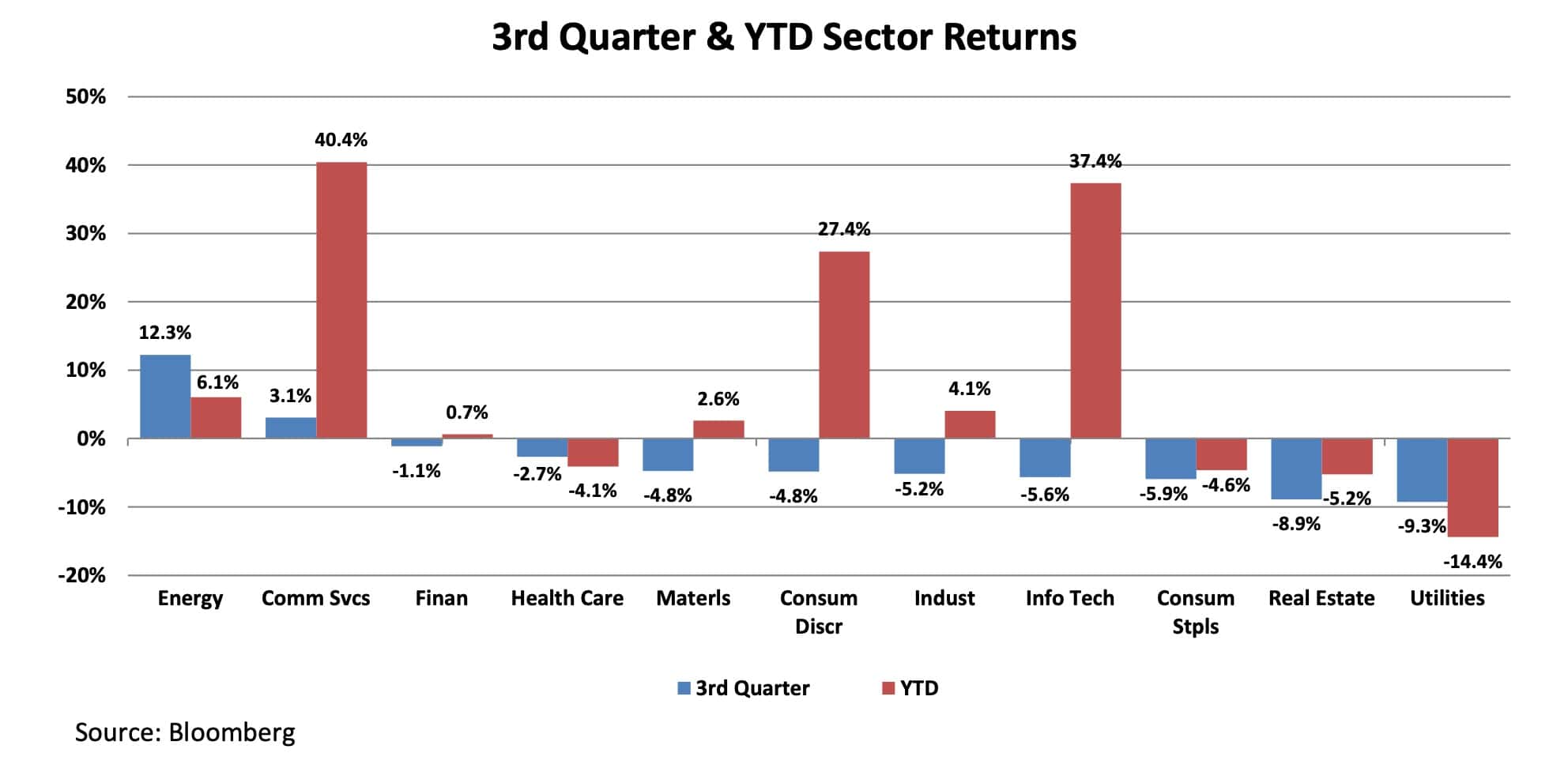

- Breaking three losing quarters, the Energy sector led the S&P 500 with a return of 12.3%.

- Value stocks and small-cap stocks continued to underperform growth and large-cap stocks.

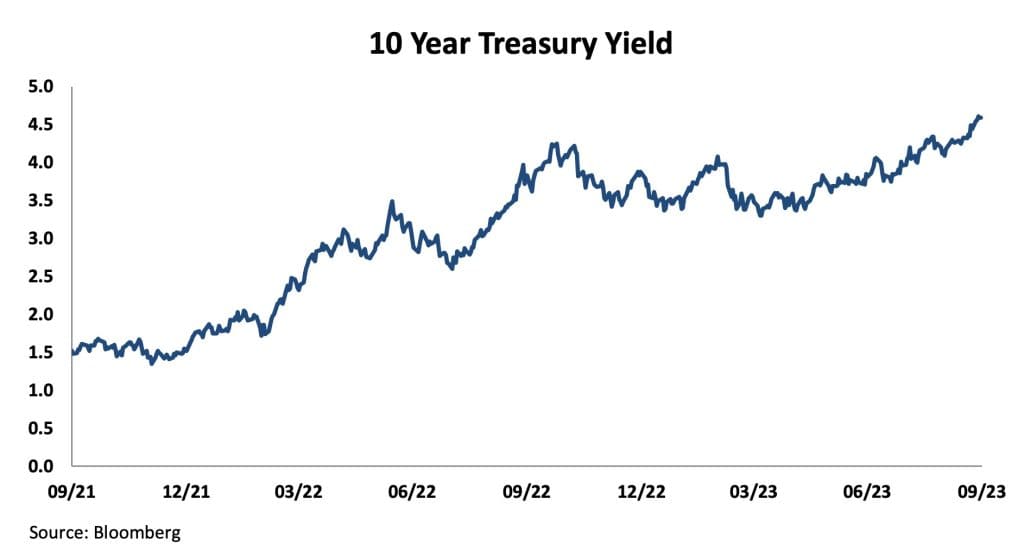

- Interest rates rose sharply, and the 10-year Treasury returned -3.1% in the third quarter.

- Headline inflation continued to moderate but remained well above the Fed’s 2% target.

- Given moderating inflation, the Fed decided to hold rates steady at its September meeting.

Source: Bloomberg

Equities

Although inflation continued to ease in the third quarter, interest rates rose as investors increasingly accepted the idea that the Federal Reserve would maintain the Fed Funds rate at its current level (or higher) for a longer period of time. With only a very slight increase in rates in July, the equity markets continued their early summer advance, with the S&P 500 gaining 3.2% for the first month of the quarter. But as investors began to assume that rates would remain higher for longer, rates rose substantially across the curve and the S&P lost 6.3% to end the quarter with a total return of -3.3%. The negative return for the quarter reduced the year-to-date return to 13.1%. (All returns are total returns, including both price changes and any dividends paid.)

Large cap stocks and growth stocks continued to perform better than other equities. Large caps outperformed small caps by 2.2% for the quarter and 18.2% for the first nine months of the year. Similarly, growth stocks outperformed value stocks by 2.0% in the quarter and 10.6% year-to-date. The returns of the S&P 500 continue to be driven by a few large companies. The seven largest (Apple, Microsoft, Nvidia, Amazon, Tesla, META, Alphabet) contributed 32% of the S&P 500’s return in the third quarter and 85% of its return year-to-date. Not surprisingly, then, the equal-weighted S&P 500 index lagged the market-cap weighted index by 1.6% in the third quarter and by 11.3% for the first nine months of 2023.

Breaking a three-quarter losing streak, the Energy sector’s returns led the S&P 500 in the third quarter as oil prices (West Texas Intermediate) gained 29%. Communications Services was the only other sector with a positive return for the quarter as its two largest components, Alphabet and META, posted positive returns. The worst performing sectors were Utilities, Real Estate, and Consumer Staples, though Information Technology, because it has the biggest weighting in the index, was the largest contributor to the S&P 500’s negative return. For the first nine months of the year, the Communications Services, Information Technology, and Consumer Discretionary sectors were the best performing sectors with an average return of 35%, while Utilities, Real Estate, and Consumer Staples were again the worst performing sectors.

As-reported earnings for the S&P 500 were up 14% in the third quarter and are expected to rise 16% for all of 2023. The ten largest market capitalization stocks in the S&P 500 account for 32% of the value of the index, but only 22% of its earnings over the last year. These ten stocks also trade almost nine multiples higher than the other 490 stocks in the index. Overall, at a little over 21 times estimated 2023 earnings, the index continues to trade at a premium to its historical multiple.

Fixed Income

Overall, fixed income provided little shelter from the third quarter drop in equities. With inflation moderating, but remaining well above the Fed’s target of 2.0%, fixed income investors finally seemed to notice the Fed’s determination to maintain higher short-term rates. This led them to sell longer-term bonds, causing a sharp rise in yields and a flattening of the curve during the third quarter.

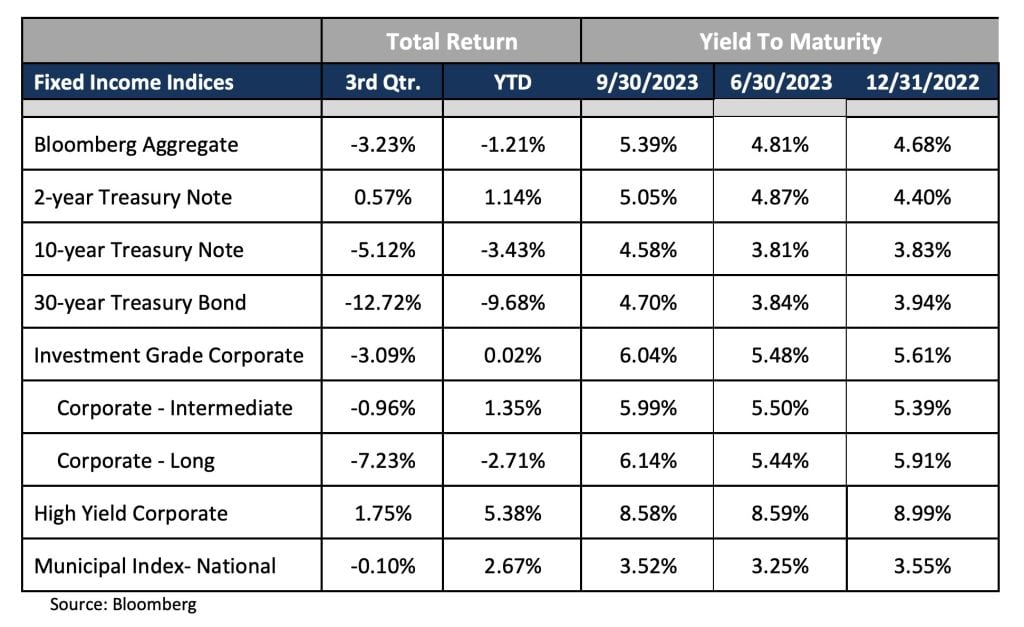

As a result, the broad market Bloomberg Aggregate Index lost 3.2% in the quarter and has now lost 1.2% in 2023. The benchmark 10-year Treasury did even worse, returning -5.1% in the quarter as its yield rose from 3.8% to 4.6%. Shorter-term securities posted better performance, with the 2-Year Treasury delivering a 0.6% return even as its yield increased from 4.9% to 5.1%. Investment-grade corporate bond returns were similar to those of comparable duration Treasuries while below-investment-grade bonds provided positive returns as their higher interest payments offset their price declines.

The latest measure of the Fed’s preferred measure of inflation, the core Personal Consumption Expenditures (PCE) price index rose 0.1% in the month of August and 3.9% for the trailing 12 months. Including food and energy, the PCE increased 0.4% for the month and 3.5% for the year. The more recent Consumer Price Index (CPI) report showed the core index up 0.3% in September and 4.1% year-over-year. Including food and energy, prices climbed 0.4% in September and 3.7% over the prior year.

Having increased the Fed Fund’s rate by 0.25% in both February and May, the Fed’s Federal Open Market Committee (FOMC) increased the rate by another 25 basis points in July to a range of 5.25% – 5.50%. With the continued moderation in the rate of inflation and a sharp rise in bond yields during the quarter, the FOMC decided not to raise rates at its September meeting. However, 2/3 of the FOMC members thought that another rate increase was likely by the end of the year and all members “agreed that policy should remain restrictive for some time” in pursuit of their 2.0% inflation target.

Market Environment

Milton Friedman famously noted that monetary policy operates with “long and variable lags.” Despite eleven increases to the Fed Funds rate in a little over a year, the economy has continued to chug along. Second quarter GDP grew at 2.1% and economists are estimating third quarter growth of 3.2%. Many investors believe the continued growth in the economy in the face of tighter Fed policy, along with a declining rate of inflation, suggests that we can escape a recession and achieve the much vaunted “soft landing,” achieving a 2.0% inflation rate without a recession.

But the increase in income (e.g., Employee Retention Tax Credits) and decrease in expenses (e.g., student loan payments) provided by pandemic era government largesse is slowly coming to an end. Most economists expect the excess consumer savings generated by such programs to be exhausted by early 2024 and signs of economic stress are already appearing among low-income consumers. Even now, we are seeing the challenges of higher rates emerge. In addition to the stress in the banking system seen earlier this year, consumers with credit card balances are feeling the effect of significantly higher interest payments and balances reached a record high at the end of June. In the corporate sector, about 20% of companies do not have operating income sufficient to cover their interest costs and the number of corporate bankruptcies has reached levels last seen in early 2020 and during the Great Recession of 2007-2009.

One significant reason the economy has not felt the full effect of higher interest rates is the very stimulative fiscal policy of the last several years. This policy has increased the national debt from $23 trillion in the first quarter of 2020 to $32.7 trillion as of this August. At the end of 2022, approximately 56% of this debt had maturities of less than 10 years and 12% had maturities of one year or less. The average interest rate on the Federal debt has risen from 1.56% in January 2022 to 2.9% in August. With maturing debt being refinanced at higher rates, the portion of the Federal budget devoted to interest expense is expected soon to exceed the cost of defense spending. While both political parties seem happy to keep incurring budget deficits, the growing interest cost on the existing debt alone will make that more difficult.

In addition to the shift in market expectations regarding the duration of higher rates, upward pressure on longer-term rates is also coming from the Fed’s Quantitative Tightening program which has allowed $1 trillion of the $9 trillion in bonds held by the Fed to mature since April of 2022. This increased supply of bonds, all other things being equal, leads to higher long-term yields. The fact that the Fed is no longer purchasing increasing amounts of government debt will also act as a brake on Federal spending. With Congress unwilling either to reform the country’s two biggest spending programs (Medicare and Social Security) or to raise taxes on most households, it will be increasingly difficult for loose fiscal policy to offset tighter monetary policy.

The implications of higher interest rates and possibly higher taxes do not bode well for corporate profits and, by implication, stock prices. A recent paper by a Fed economist concludes that more than 40% of the profit growth in the S&P 500 over the last 20 years has been due to falling interest rates and lower taxes. Those days are clearly behind us. With growth more difficult to achieve, investors will need to be more attentive than ever to managing risks to achieve returns.

Focusing on Long-Term Results

These remain challenging times for all investors. Navigating the risks in this market environment requires consistent focus on long-term goals and an appropriate allocation of assets. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.