Highlights

- Adding to its 18.4% gain in 2020, the S&P 500 returned 6.2% in the first quarter.

- Just like the fourth quarter, value stocks outperformed growth stocks, in this case by 8.7%.

- The broadest measure of the fixed income markets lost 3.4% as interest rates rose in the quarter.

- Real GDP grew at an annual rate of 4.3% in the fourth quarter but fell 3.5% for all of 2020.

- As the number of COVID-19 vaccinations increase, economic growth is expected to accelerate.

- Real GDP growth is forecast to be 6.5% in 2021, bringing the two-year annual growth to 2.8%.

Equities

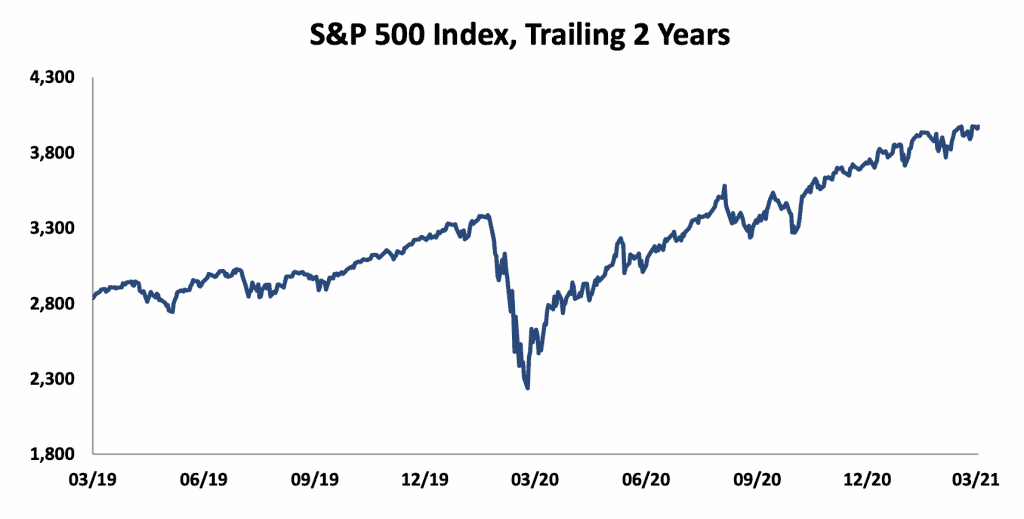

What a quarter! It opened with a riot on Capitol Hill that seemed to spill over into a riot in the stock market as a mob of individual investors, many encouraging each other on the Reddit website’s r/wallstreetbets, drove the heavily shorted stock of GameStop to stratospheric heights. The video game retailer’s stock price, which had already increased almost five-fold since August, soared from $19.95 on January 12 to as high as $483 on January 28. This investment frenzy was typical of the risk-taking appetite that continued throughout the first quarter of 2021. For even as interest rates rose and another stimulus bill raised the risk of inflation, investors took the S&P 500 to a 6.2% return in the first quarter.

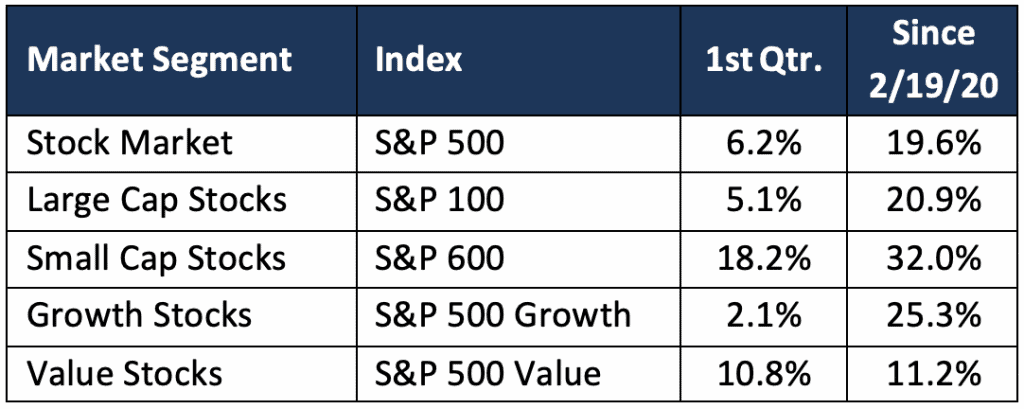

As shown in the table below, small capitalization stocks led the equity market higher in the first quarter, gaining 13.1% more than the largest stocks. Value stocks continued their fourth quarter outperformance vs. growth stocks, in this case by almost 9%. Interestingly, despite the drop in economic activity and employment since the pre-COVID market peak on February 19 of last year, the overall market is up almost 20% through the end of March, with small cap stocks and growth stocks up even more.

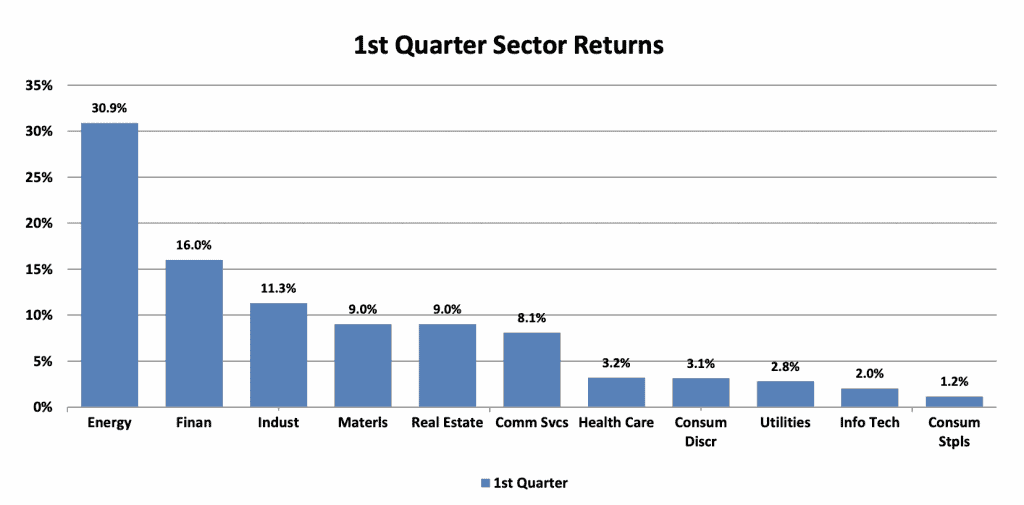

Every sector produced positive returns in the first quarter. Value stocks again benefitted from the strength of the Energy and Financial sectors, which are more heavily weighted in that index. The strength of those sectors reflected the sharp rise in interest rates and the continued climb in the price of oil during the quarter (from $48.52 to $59.16 for West Texas Intermediate). The Information Technology sector, which is heavily weighted in the growth index, returned only 2.0% and was trailed by only the defensive Consumer Staples sector at 1.2%.

After a drop of 22% in 2020, S&P 500 earnings are now forecast to increase 41% in 2021 and 16% in 2022 on the back of increasing amounts of fiscal stimulus. This puts earnings for 2021 about 10% higher than 2019 earnings, even while the market has gained over 24% since the beginning of 2020. As a result, although earnings estimates have risen since the beginning of the year, the rise in stock prices leaves the market’s P/E ratio at a still very elevated level of 23 times 2021 earnings, a level last seen in the dot-com bubble of 1999-2000. The S&P 500 also remains a very concentrated index with the five and ten largest stocks accounting for 20.6% and 27.4% of its value, respectively.

Fixed Income

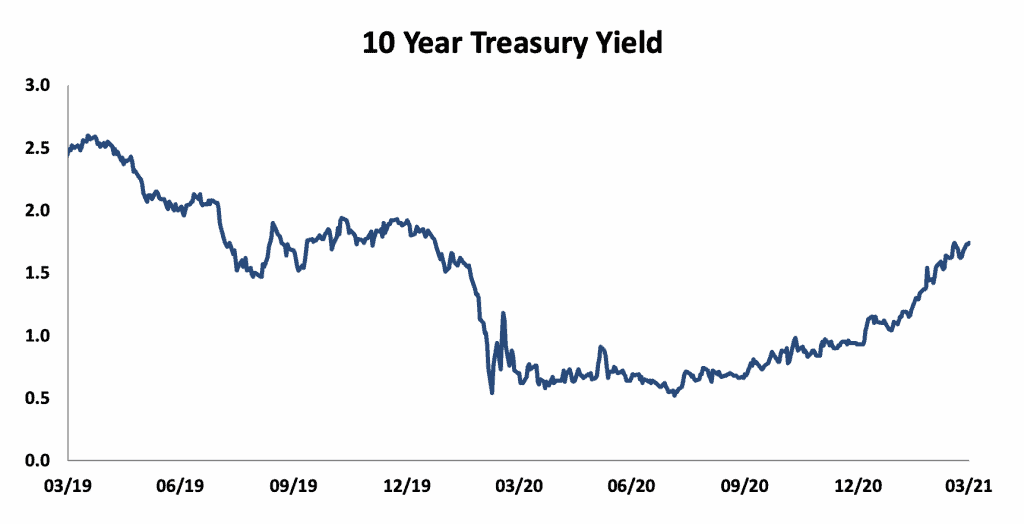

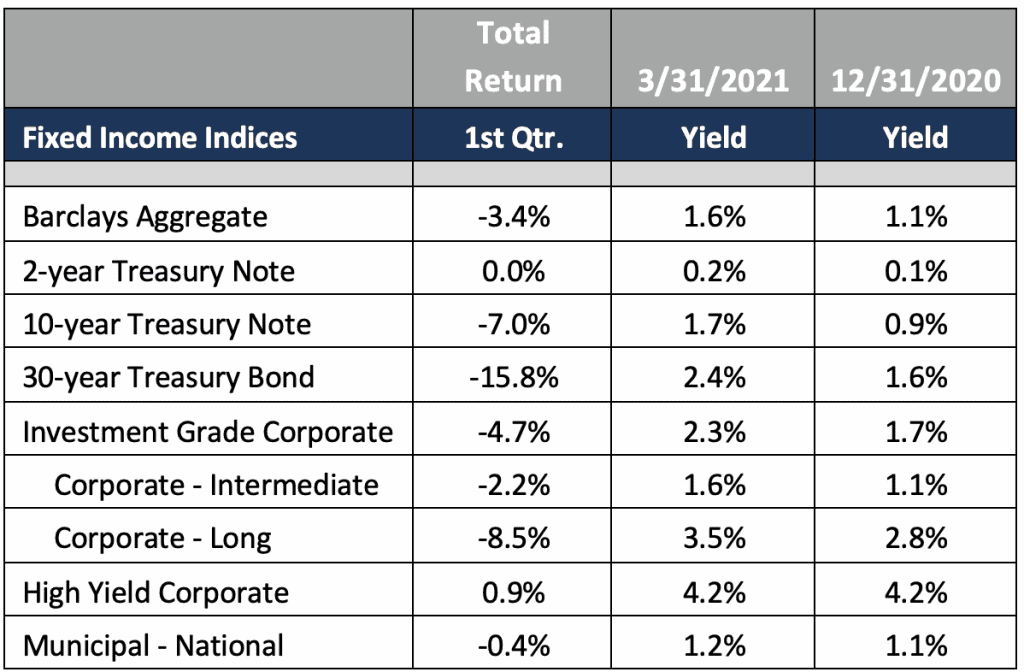

The aggressive fiscal policies of the last twelve months, the Biden administration’s plans for more spending, and the supply shortages resulting from Covid-19 all led to increased fears of inflation and a rise in interest rates during the first quarter. As a result, theBarclays Aggregate Index (the broadest measure of the fixed income market) lost 3.4% (total return) for the quarter. Federal Reserve Chairman Powell confirmed in late March the Fed’s intention to keep interest rates at historically low levels (Fed Funds target of 0.0% – 0.25%) for an extended period of time and to tolerate inflation higher than its officially targeted 2.0% level.

The increased concerns about inflation were primarily reflected in longer-term bond yields, which continued a rise begun in the fourth quarter. The 10-year U.S. Treasury yield increased from 0.92% at the end of 2020 to 1.74% at the end of the first quarter. Longer maturity Treasuries had greater losses than shorter term issues as the yield curve steepened. As a result of the rise in yields, most bonds had negative total returns in the quarter. Investment grade corporate bonds outperformed Treasuries as their risk premiums (spread over Treasuries) compressed, particularly on longer maturity issues. Municipal bonds (national index) posted a small loss for the quarter. High yield (below-investment-grade) bonds benefitted from both tighter spreads and a higher coupon, which more than offset the decline in price and led to just under a 1.0% positive return.

Market Environment

The economy is expected to rebound sharply in 2021 as the number of vaccinated people increases. At the end of March, 130 million people in the United States had received a vaccination, with 52.4 million fully vaccinated and shots being given at the rate of 2.8 million a day (seven-day average). Inflation-adjusted (real) Gross Domestic Product (GDP), which fell 3.5% in 2020, is now forecast to grow 6.5% in 2021.

On top of the natural rebound in economic activity as COVID-19 cases fall, the Federal government continues to inject massive amounts of fiscal stimulus into the economy. On March 11, President Biden signed the $1.9 trillion American Rescue Plan Act, a COVID-19 stimulus bill. Within days, payments of up to $1,400 were being deposited in the accounts of over 90 million individuals. This legislation followed the $2.2 trillion CARES Act of last March, which provided $1,200 checks to individuals, and December’s $920 billion Consolidated Appropriation Act, which provided for payments of $600 to individuals. All this spending equals 23% of 2020’s GDP of $21.5 trillion. In addition, the proposed infrastructure legislation calls for $2.3 trillion in spending (another 11% of GDP) and there is talk of another $1 trillion in social spending.

This substantial fiscal stimulus over the last year has reinforced the monetary stimulus provided by the Federal Reserve over the last ten years, most recently in its pledge to maintain short-term rates at the “zero bound” until it decides that the “average” of current and past inflation has hit its 2% target. (Notice that this is not a measure to which the Fed can be held accountable.) All this money sloshing around is the root cause of the speculative zeitgeist of today’s investment world. That speculative spirit continued to manifest itself in different ways during the first quarter as illustrated in the three examples below.

Surge in SPACs. One example of the investor risk appetite was the continued dramatic growth in SPAC (Special Purpose Acquisition Companies) initial public offerings. After raising a record $83 billion in 2020, SPACs raised another $95 billion in the first quarter for investment in whatever private company the SPAC organizers could find. Just as GameStop buyers weren’t focusing on the business fundamentals, many SPAC investors have even been willing to buy shares in the secondary market at prices higher than the value of the cash raised, particularly if the SPAC has announced a merger with a “green” technology company.

Stretching for Yield. Fundamentals may not matter much to GameStop or SPAC investors, but other investors assume excessive risk in an effort to generate income in a world where safer investments offer little to no yield. Such were the investors who put at least $10 billion in Credit Suisse’s supply-chain investment funds that purchased bonds issued by Greensill Capital. These bonds were collateralized by loans that Greensill advanced to its clients by paying their invoices, advancing funds on their receivables, or even on their “future accounts receivables”. Since neither Greensill nor its clients were the best credits (three major accounting firms had refused to take on Greensill Capital as an audit client in 2020), the Credit Suisse investors required credit support in the form of an insurance policy. It was the lapse of that insurance that led to Greensill’s bankruptcy in March. Credit Suisse still hopes to recover enough funds to make its investors whole.

Over-leveraged Investments. Then you have a more old-fashioned type of speculative bust, the collapse of Archegos Capital near the end of the quarter. This $10 billion family office controlled $50 billion worth of stock in companies such as ViacomCBS, Discovery, and Chinese search giant Baidu. Archegos was able to control stock worth five times its own capital due to the generous provision of leverage by the likes of Morgan Stanley, Goldman Sachs, Deutsche Bank, and Credit Suisse. Naturally, Archegos increased its borrowing as the value of its portfolio increased. But a sudden drop in the share prices of some of its holdings triggered margin calls that Archegos could not meet. While most of its creditors were able to liquidate their exposure without losses, Credit Suisse has announced a loss of $4.7 billion. In the case of Archegos, the lenders do not seem to have realized the extent to which others were also lending to the company. Unfortunately, having a blind eye to risk facilitates much of the speculative investment activity seen today. Like teenagers, investors make little allowance for the possibility of things going wrong. And they count on monetary and fiscal authorities to ride to the rescue of an increasingly leveraged financial system. But as we all discovered through the supply- chain disruptions of 2020, a system built with no allowance for things going wrong is a very fragile one.

Focusing on Long-Term Results

With stocks at lofty valuations and bond yields low, these are challenging times for all investors. Navigating this market environment requires consistent focus on long-term goals and an appropriate allocation of assets. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.