Highlights

- Rising inflation and interest rates led to losses in both the stock and bond markets.

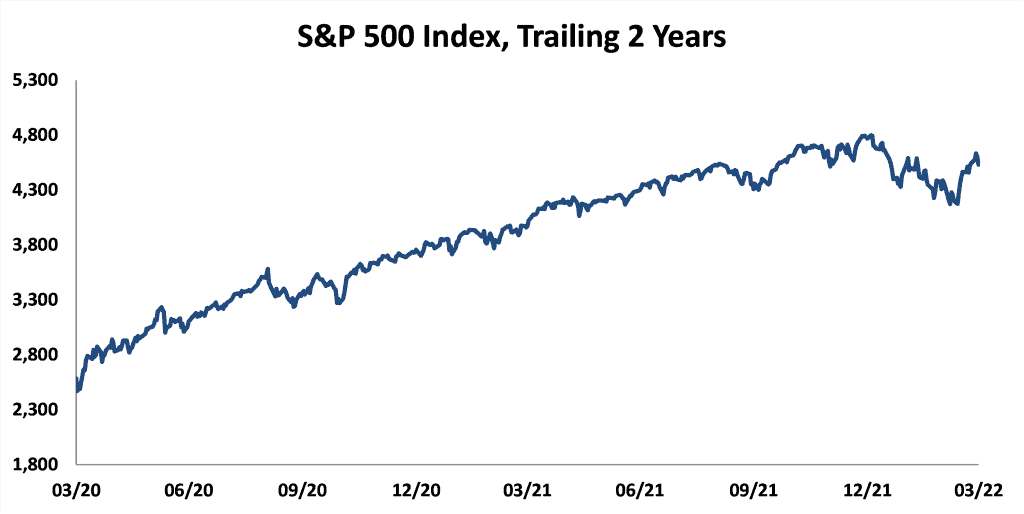

- After gaining almost 29% in 2021, the S&P 500 returned -4.6% in the first quarter.

- Bond returns were even worse, with the Barclays Aggregate down 5.9% for the quarter.

- Value stocks outperformed growth stocks by 8.8% in the first quarter.

- The rate of inflation continued to increase, with CPI up 7.9% in February.

- At the end of March, the S&P 500 traded at over 19 times estimated next 12-month earnings.

Equities

War and inflation sound like a bad combination for stocks. However, it turns out they’re even worse for bonds and, on closer examination, war may not be nearly as important to markets as inflation. The early February CPI report showed inflation rising at a 7.5% annual rate (a 40-year high and ahead of the 7% annual rise reported in January). As a result, fears of inflation and higher rates had already pushed the S&P 500 down over 11% from its January high on February 23, the day before the Russian invasion of Ukraine. The S&P 500 return bottomed (-12.3%) on March 8 before growth stocks staged a rally in the second half of March that reduced the loss for the quarter to -4.6%.

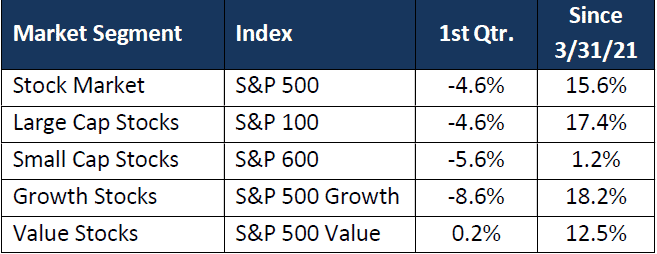

As shown below, large capitalization stocks outperformed small cap stocks by 1.0% in the first quarter and have outperformed small caps by over 16% for the last year. Value stocks, which have lagged growth stocks for years, outperformed by 8.8% in the first quarter.

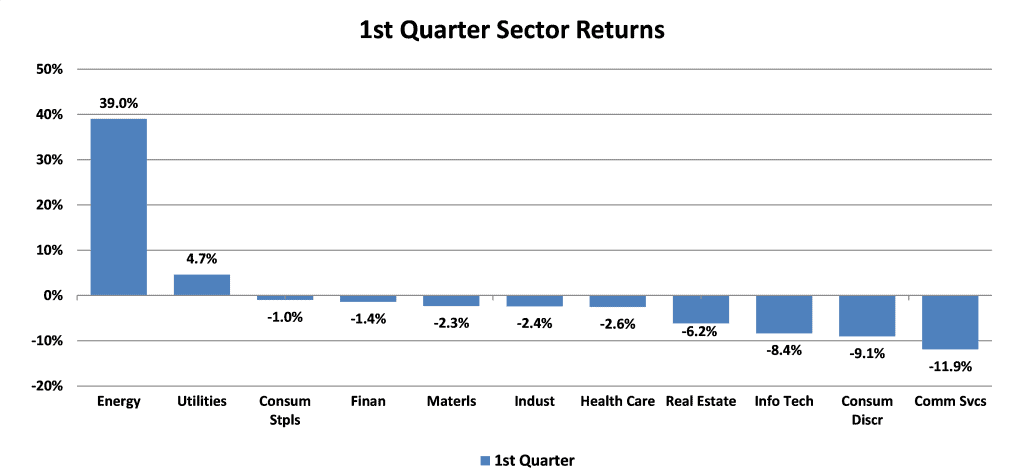

The 42% rise in oil prices (West Texas Intermediate) led to the Energy sector’s stunning returns in the first quarter. Along with Utilities, it was one of only two sectors posting a positive return. As a reminder, the Energy sector’s gain came on top of its 55% return in 2021 when it was also the best performing sector. Communications Services, Consumer Discretionary, and Information Technology were the worst performing sectors in the first quarter. All of them had delivered returns of over 20% in 2021.

Reported earnings for companies in the S&P 500 increased 70% in 2021 in response to the record levels of fiscal stimulus. Estimates for 2022 call for a 6% increase over 2021. At the end of March, the forward 12-month P/E ratio for the S&P 500 stood at 19.5 which compares to a 5-year average of 18.6 and a 10-year average of 16.8. Concentration in the S&P 500 remained high, with the top 10 stocks accounting for 30.7% of the market capitalization. The 12-month forward P/E ratio for those 10 stocks was 30.7 compared with a ratio of 16.6 for the remaining stocks in the S&P 500.

Fixed Income

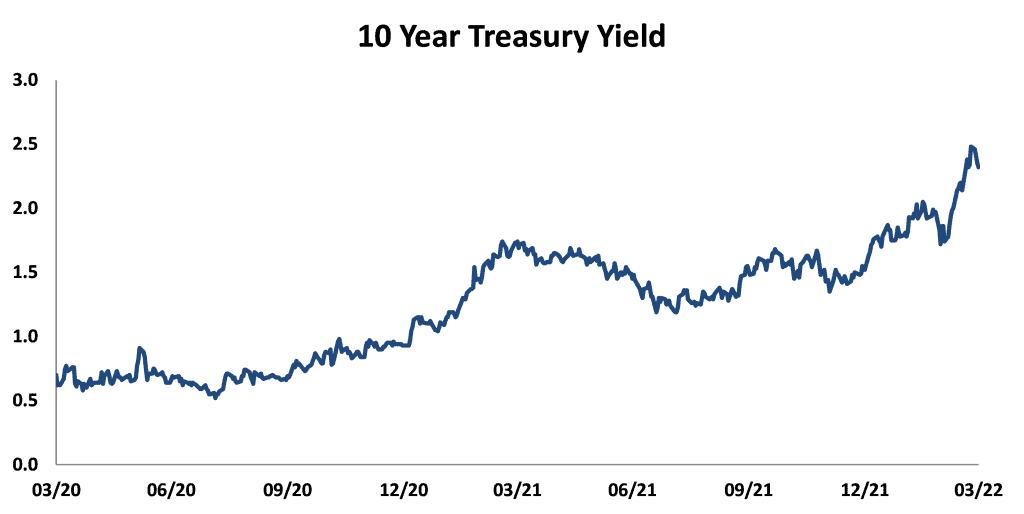

Fixed income markets in the first quarter were much more sensitive to rising inflation pressures than the equity markets. As measured by the Consumer Price Index, inflation came in at 7.9% in February, higher than any reading since 1982. The Fed’s favored PCE measure rose 6.4% in February year over year (5.4% excluding food and energy). In both cases, the rate of inflation continued to increase from prior months.

At its March 16 meeting, the Federal Open Markets Committee (FOMC) announced a 25 basis-point increase in the Federal Funds target range to 0.25% – 0.50%. The FOMC also reiterated its intention to continue to increase rates to a level sufficient to reduce the rate of inflation, with some participants willing to implement 50 basis point increases. The FOMC also indicated that it would move more aggressively than it had in 2018-19 to reduce the size of its balance sheet, beginning the reduction “possibly as early as” the Committee’s next meeting in May.

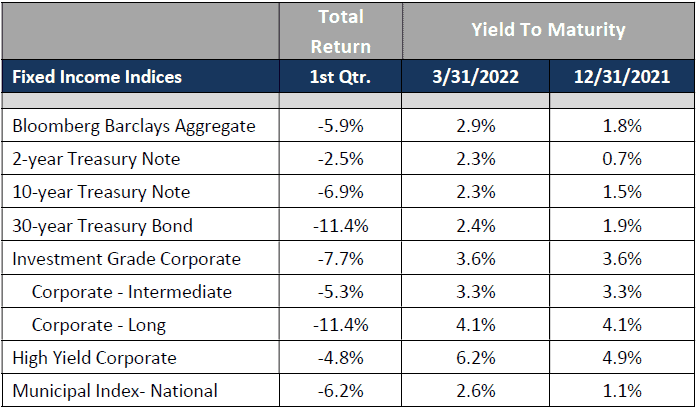

The yield curve flattened substantially in the first quarter with the 2-year Treasury Note yield increasing 160 basis points to 2.3% while the 10-year Note and 30-year Bond yields rose only 80 and 50 basis points to 2.3% and 2.4%, respectively. Rising rates led to losses across the fixed income market, with the Bloomberg Barclays Aggregate Index posting a loss of 5.9% in the first quarter. Longer-term issues fared worse than shorter-term bonds and corporate bonds returned less than comparable Treasuries as credit spreads widened in response to heightened perception of risk. High-yield (“junk”) bonds lost less than comparable maturity investment-grade bonds due to their credit spreads not increasing as much. Municipal bonds were not so fortunate as their yield to maturity increased by almost 50% and they lost 6.2% in the first quarter.

Market Environment

The key investment issue today is whether the Federal Reserve can curb inflation without triggering a recession. The central bank’s very loose monetary policy since 2010 (“lower for longer”) led to significant inflation in asset prices (e.g., real estate, housing) but did not lead to higher prices for goods and services. This lack of broader inflation resulted from the fact that much of the money “printed” by the Fed remained within the banking system since banks lacked sufficient loan demand. But the tremendous amount of money injected directly into the economy since 2020, along with supply chain issues resulting from the COVID-19 epidemic, unleashed a level of inflation not seen since the early 1980s. Having extended its loose monetary policies well past the economy’s recovery from the COVID induced downturn, the Fed is now trying to play catch-up in its attempt to dampen an increasing rate of inflation. History suggests that it will be difficult for the Fed to achieve its goal without causing a recession.

Unfortunately, it is possible that tighter monetary policies may lead to an economic contraction without bringing inflation down to the Fed’s 2% target. Some of the causes of inflation are beyond the Fed’s control. For example, oil and gas companies were investing less in exploration and production in response to public policy that increasingly favored non-carbon sources of energy and investor demand for a greater focus on returns over production growth. With the rebound in demand following the easing of COVID-19 restrictions, oil prices rose last year and early this year. In a carbon-based economy, this increased cost of energy flows through to every other good and service.

The Russian invasion of Ukraine and the sanctions imposed by Western governments have only increased the energy supply challenges. Although it is not clear how quickly Europe can wean itself from cheap Russian energy, it does seem that it will be increasingly difficult for Russia to continue its pre-war level of oil and gas production in the face of Western restrictions on supplies and technology needed to drill for new oil and to keep existing wells running. The war has also affected the supply of other broadly consumed commodities. With Ukraine responsible for 14% of the world’s exported corn and 10% of its exported wheat, it is no surprise that wheat and corn prices rose 31% and 26%, respectively, in the first quarter. Prices of key metals produced by Russia or Ukraine, such as nickel and copper, have also risen and shortages are expected to affect supply chains for a broad array of products.

Other, longer-term, developments suggest that higher inflation may be with us for a while. Over the last several years, we have seen increasing signs that a long era of increasing globalization may be coming to an end (e.g., increasing tariffs, problems with elongated supply chains). Globalization of production provided sustained downward pressure on prices as substantially less expensive labor replaced more expensive labor. The cessation or even reversal of that global economic integration should have the opposite effect. Similarly, the aging of the workforce in many of the world’s major economies (United States, Europe, China, Japan) may exert upward pressure on wages.

In the face of all these inflationary pressures the Federal Reserve is raising short-term rates and planning to stop quantitative easing (purchasing government or other bonds to depress longer-term rates). The unprecedented amount of debt purchased by the Federal Reserve over the last twelve years, and especially in the last two years, has resulted in the Fed needing to determine how to reduce its balance sheet and let longer rates rise without smothering economic growth or causing a destabilizing drop in asset prices. Analysts are divided on how successful they believe the Fed will be in bringing inflation down without producing a recession or whether in fact we could have the unpleasant, but not unprecedented, combination of higher inflation and a slowing economy (stagflation). One thing that is clear is that the macro-economic risks to the bond and equity markets have not been this high for many years.

Focusing on Long-Term Results

These remain challenging times for all investors. Navigating the risks in this market environment requires consistent focus on long-term goals and an appropriate allocation of assets. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.