Highlights

- The S&P 500 returned 12.1% for the quarter and 18.4% for all of 2020.

- Value stocks outperformed growth stocks in the quarter but trailed by 32% for the year.

- The 2020 gain in the S&P 500 was driven by a small number of large growth stocks.

- The fixed income markets returned 0.7% for the quarter and 7.5% for the year.

- The economy continued to rebound, but GDP remained below pre-pandemic levels.

While 2021 should see strong earnings growth, valuations stand at record highs.

Equities

“Stocks only go up.” — Dave Portnoy, founder of Barstool Sports (a sports and pop culture website) and day trader with 1.5 million Twitter followers.

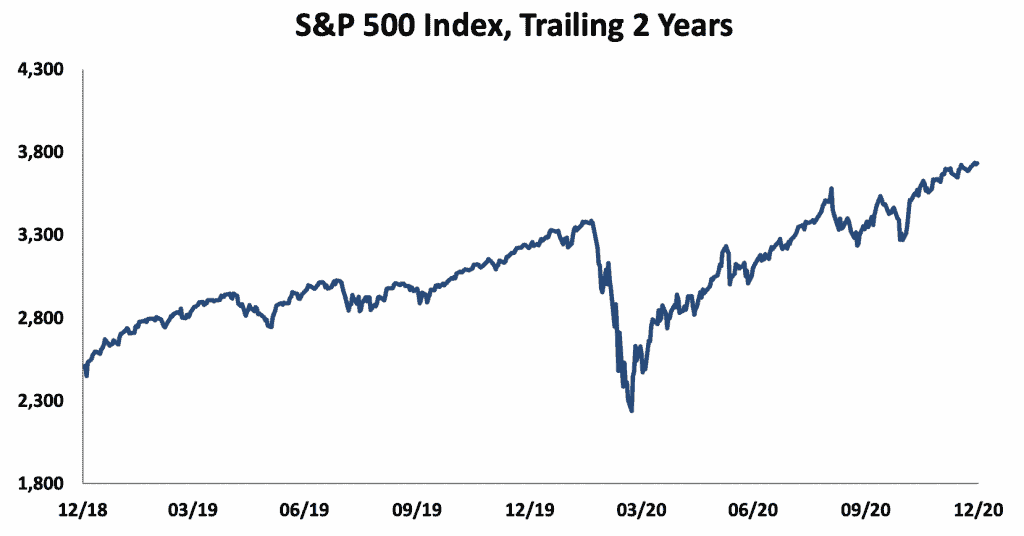

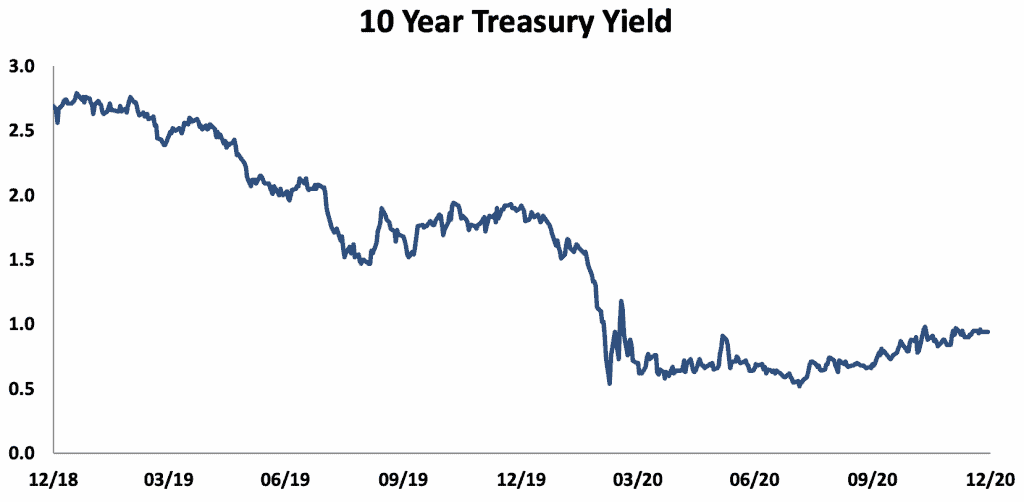

It sure seems that way, at least since the one-month long pandemic induced sell-off that ended in late March. Since then, with the Fed providing unprecedented monetary stimulus, interest rates have fallen and remain at extremely low levels, encouraging the assumption of risk to generate both income and capital appreciation. In such an environment, speculators have thrived and seemingly replaced betting on sports with betting on stocks. Despite an economy substantially weaker than it was a year ago, stock indices have set one record high after another. In the fourth quarter, the S&P 500 returned 12.1%, bringing its return for the full year to 18.4%. This strong performance follows a 31% return in 2019.

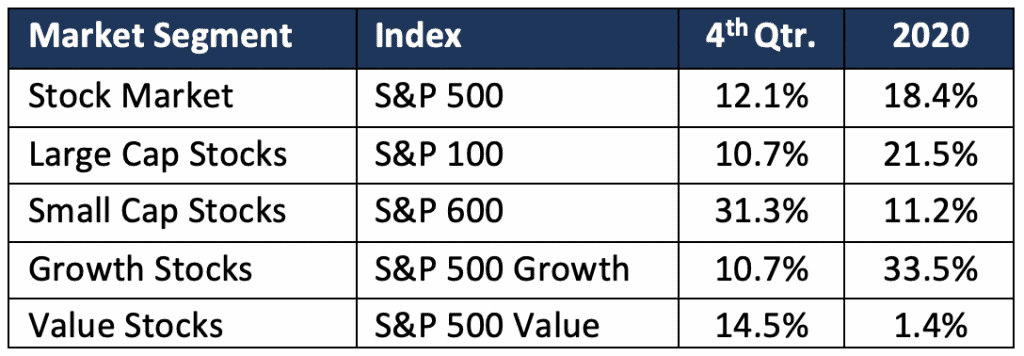

As shown in the table below, while smaller stocks and value stocks led the market in the fourth quarter, the largest capitalization stocks outperformed small cap stocks by over 10% and growth stocks outperformed value stocks by over 32% for all of 2020.

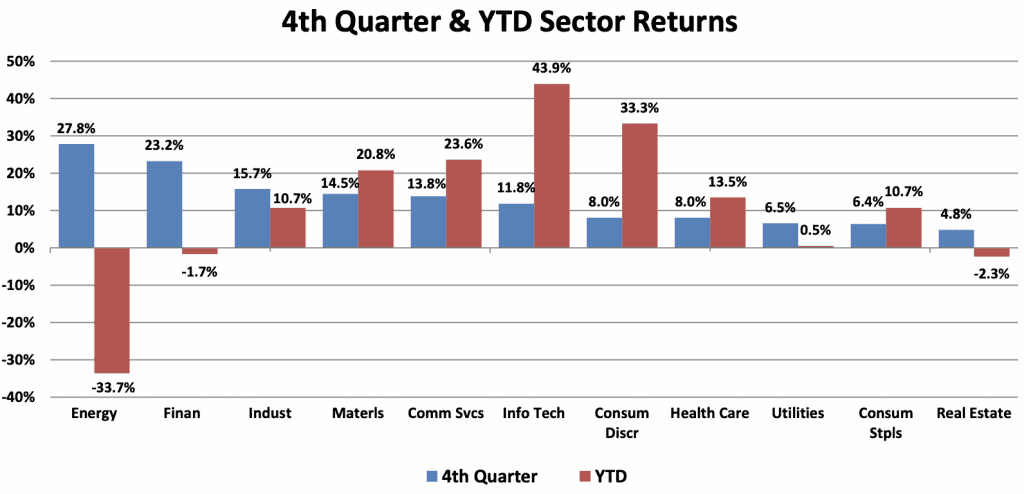

The major reason for the strong performance of the value index in the fourth quarter was the rebound of Energy and Financial stocks, although both sectors finished the year with negative returns. Every sector produced a positive return for the quarter. The two best performing sectors for the year, by a wide margin, were Technology (+44%) and Consumer Discretionary (+33%). The Communication Services sector (+24%), which includes Alphabet/Google and Netflix, was the third best performing sector in 2020.

For the most part, the S&P 500’s new highs have depended on a remarkably small group of very large growth stocks. With the Technology sector gaining over 90% and the Communications sector over 55% in the last two years, the concentration in the S&P 500 has continued to increase. At the end of 2020, the ten largest companies accounted for 27 % of the index’s value, compared to 23% at the end of 2019 and 21% at the end of 2018. Apple, Amazon, and Microsoft alone accounted for over half of the S&P 500’s return in 2020 while the top 30 contributors accounted for 100% of the return. (Without them, the S&P’s return would have been -0.03%.)

The 23.5% drop in earnings in 2020 and the rise in stock prices has led to stocks trading at valuation levels last seen in the 1998-99 dotcom era. At the end of 2020, the forward 12-month P/E ratio for the S&P 500 stood at 23 times estimated operating earnings for 2021. These earnings, which exclude write-offs, are expected to be up 36.7% in 2021. However, this represents a gain of only 4.6% over 2019 earnings. Despite this unimpressive earnings growth, the S&P 500 ended the year at a record high after recording 20 new closing highs since the pre-Covid market peak on February 19 of this year.

Fixed Income

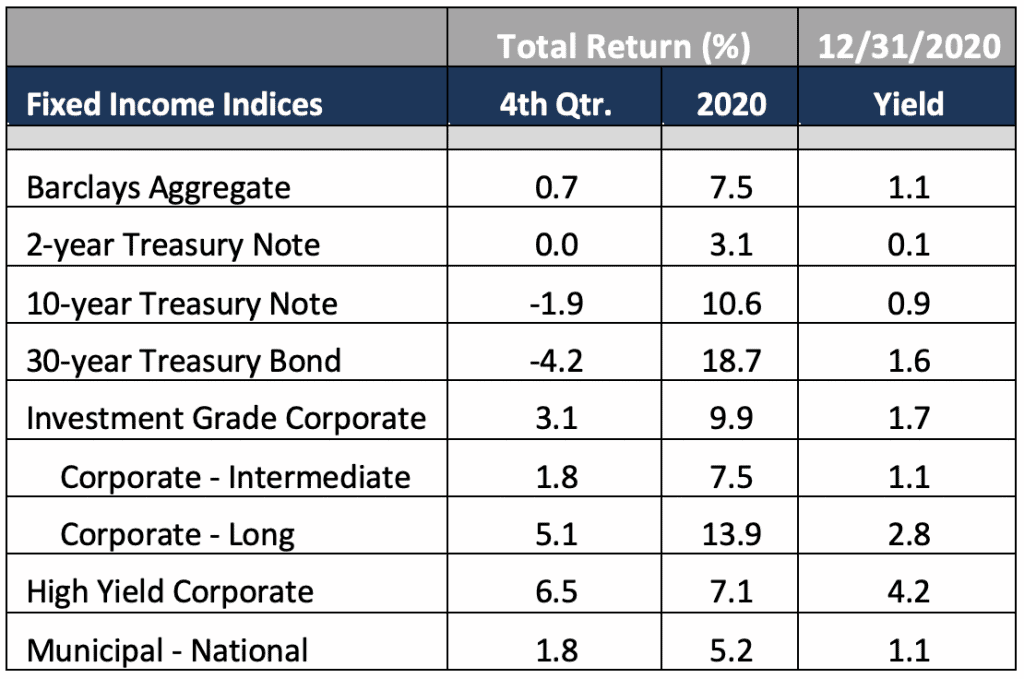

While the stock market steamed ahead in the fourth quarter, the bond market finished 2020 on a more modest note. The Barclays Aggregate Index (the broadest measure of the fixed income market) returned 0.7% for the quarter and 7.5% for the year. The Federal Reserve maintained the Fed Funds rate target range at 0.00 – 0.25% and committed in December to continue buying at least $120 billion of bonds each month to keep interest rates low (quantitative easing). Although consumer and wholesale price increases remained muted, increasing fears of inflation drove Treasury rates higher in the fourth quarter, leading to losses on issues with maturities longer than three years as the drop in principal value more than offset coupon payments.

While Treasury rates served to push all bond yields higher, investors’ willingness to accept a lower risk premium over Treasuries resulted in positive returns for corporate bonds. The increased appetite for risk was evident in the fact that longer maturity and lower quality bonds outperformed their shorter maturity and higher quality counterparts. Longer maturity corporate bonds returned over 3% more than intermediate maturity bonds in the quarter and over 6% more for the full year. At the same time, narrower credit spreads boosted the return from high-yield (“junk”) bonds ahead of that from investment-grade corporates in the fourth quarter. However, that fourth quarter return was not enough to overcome the losses of the first quarter and so high-yield bond returns trailed investment-grade issues for the year. Meanwhile, a national index of municipal bonds posted positive returns for both the quarter and the year. Although bond returns for 2020 were strong across the board, prospective yields in the low single-digits mean that returns in 2021 will remain highly sensitive to any signs of an increase in inflation.

Market Environment

While rebounding sharply in the third quarter, GDP remains 3.5% below its pre-pandemic level. The unemployment rate was 6.7% in December, down from 7.8% in September, but still higher than the pre-pandemic 3.5%. (The more comprehensive Bureau of Labor Statistics’ U-6 measure of under-employment and unemployment was 11.7% in December.) The increase in Coronavirus infections and the roll-out of a vaccine suggest that the pandemic may show real signs of ebbing sometime in the second quarter. Although this is positive for the economy, recovery in employment is likely to be slow as many small businesses have been hurt badly and digital tools that can replace labor have seen accelerated development and adoption over the last nine months.

The unprecedented action of the Fed in 2020 to backstop bond and, by extension, equity markets has encouraged risk-taking by investors. Signs of this speculative environment abounded in 2020. Individuals accounted for 20% of the trading in 2020 vs. 10% in 2019, with a record ten million new brokerage accounts being opened. Robinhood, the online brokerage platform aimed at Millennials, offered “free” shares to anyone who opened an account and encouraged investors to trade options to leverage their investable funds. (Options trading volumes set records in 2020.) Many of those new investors followed the approach of Dave Portnoy, the flamboyant founder of Barstool Sports, and made short term bets on stocks without any research. Hence, Hertz shares rose after the company declared bankruptcy and Tesla and Apple shares soared on the announcement of a stock split. Online forums on Facebook and TikTok, like chat rooms in the late ‘90s, offered tips on the next hot stock. The IPO market was very strong, with the unprofitable food delivery company Doordash ending its first day as a public company with a market capitalization of $60 billion, while Airbnb’s first day market capitalization exceeded that of Hilton, Hyatt, and Marriott combined. Investors also poured a record $74 billion into over 200 publicly traded Special Purpose Acquisition Companies (SPACs), which promised to make good acquisitions of “something”. Tesla’s stock gained over 700% and its market cap per car sold exceeded $1.2 million as compared with $9,000 for each car sold by General Motors.

In late December, Congress finally agreed on a new Coronavirus relief package that will provide direct payments of $600 to individuals with less than $75,000 in annual income. Couples with less than $150,000 in income will receive $1,200 and an additional $600 for each additional child. In addition, the new law provides for additional funding for the Paycheck Protection Program and supplemental unemployment benefits of $300 per week (down from $600 in the first CARES Act) through mid-March. As 2021 begins and the Biden administration takes office, it appears that increased Federal spending for Coronavirus relief is likely.

However, such relief does not come without an increase in longer-term risks. Despite strong third quarter economic growth, Federal debt at the end of the 2020 fiscal year on September 30 stood at 100% of GDP, up from 79% at the end of fiscal 2019. Federal spending in fiscal 2020 grew by 47% to $6.6 trillion. Notably, spending on Medicare, which is projected to grow rapidly over the next several years, exceeded spending on defense for the first time. Overall non-discretionary entitlement spending (Medicare, Medicaid, Social Security) grew by 10.8% in fiscal year 2020. With spending up and tax receipts down by about 1%, the annual deficit tripled to $3.1 trillion and debt held by the public increased by $4.2 trillion. Despite the higher taxes proposed by President-elect Biden, his even higher spending proposals, along with the growth in healthcare spending, will lead to a growing debt burden. While the Federal Reserve has been facilitating this debt issuance with its open market purchases, the decline in the value of the dollar reminds us that that this monetization of the debt increases the risk of higher inflation.

Focusing on Long-Term Results

With stocks at lofty valuations and bond yields low, these are challenging times for all investors. Navigating this market environment requires consistent focus on long-term goals. At Buckhead Capital, we work hard to help our clients clarify and achieve their financial goals. We try to understand the lessons that markets have provided and to use that knowledge in structuring portfolios to preserve and grow our clients’ capital. We continue to emphasize achieving an appropriate return for the risk taken. We do this not only through asset allocation (the mix of stocks, bonds, and cash) but also through individual security selection, sector weightings, and, in fixed income, target portfolio maturities/durations. This attention to risk management has historically produced better risk-adjusted returns over full market cycles. We continue to believe that this market cycle will be no exception.