Many young professionals give little thought to their retirement. And why should they? It is often 40-45 years away. There are “more important” priorities to address first; buying a car, buying a house, and traveling the world (at least pre-COVID). While these are all important goals, saving for retirement CANNOT be neglected.

While we could argue over the “rules of thumb” and the importance of saving, a more helpful exercise is looking at a real example that is applicable to any level of income. How MUCH you save is important, but let me stress the importance of saving (and investing) NOW.

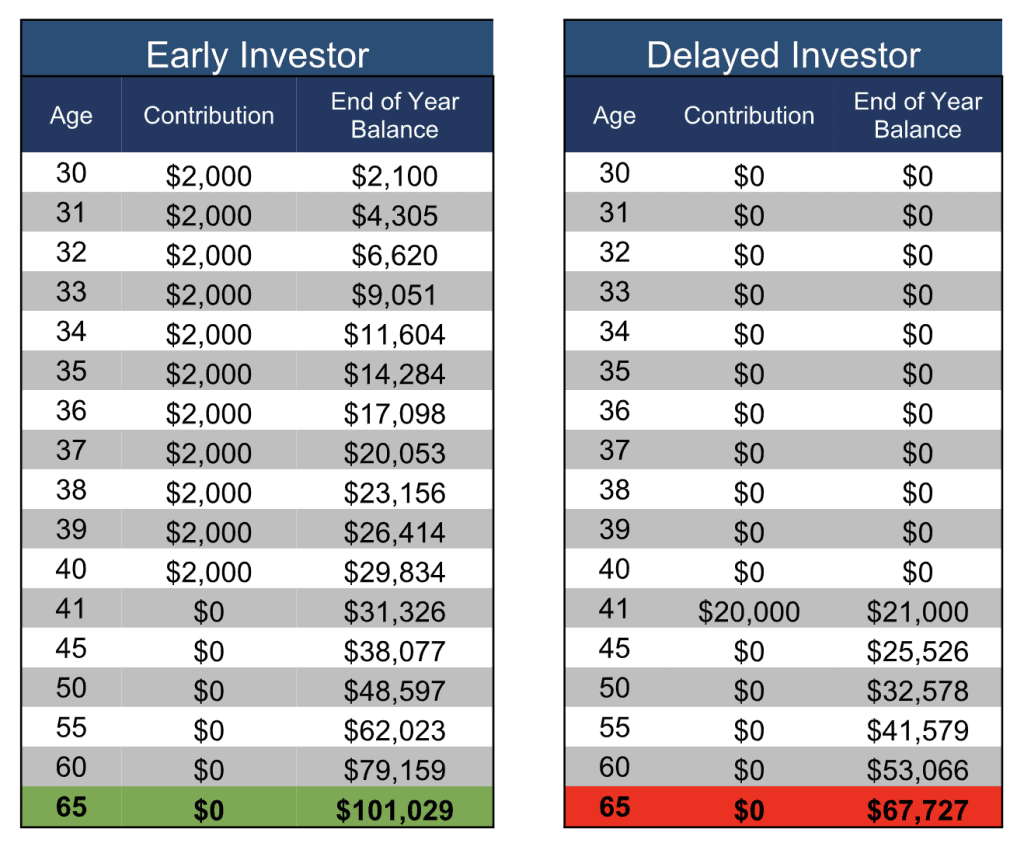

Feel free to skim the chart below. It’s primarily for reference as I give you the “CliffsNotes” version further down. The basic assumptions are as follows:

- The “Early Investor” deposits $2,000/year for 10 years.

- The “Delayed Investor” deposits a lump sum of $20,000 in year 11.

- Each invests the same amount in total.

- We assume a linear return of 5% per year over each investor’s career.

- All funds remain invested until retirement at age 65.

So, what does this exercise represent?

In technical terms, it represents a principle known as Compound Return. If you are interested, I encourage you to read more about the concept on Investopedia. The longer you have money working for you, the exponentially greater the potential for investment growth becomes.

In terms of cold, hard numbers, it means that the “Delayed Investor”, despite saving the same amount of money, missed out on 10 years of growth and a 33% greater return on investment.

The moral of the story is, as soon as you are able, start saving and investing – no matter the amount. Do not feel as if you must build up some large nest egg of cash before you take action. Access to legitimate investment resources is more readily available now than ever, so take advantage now!